Hey guys, I know I’ve been absent for the past month and haven’t provided an analysis of everything happening globally, especially in our favorite country, America, on which our investments depend. But sometimes I can’t write a detailed analysis due to obligations with my primary job. That doesn’t mean I haven’t been following what’s happening, though.

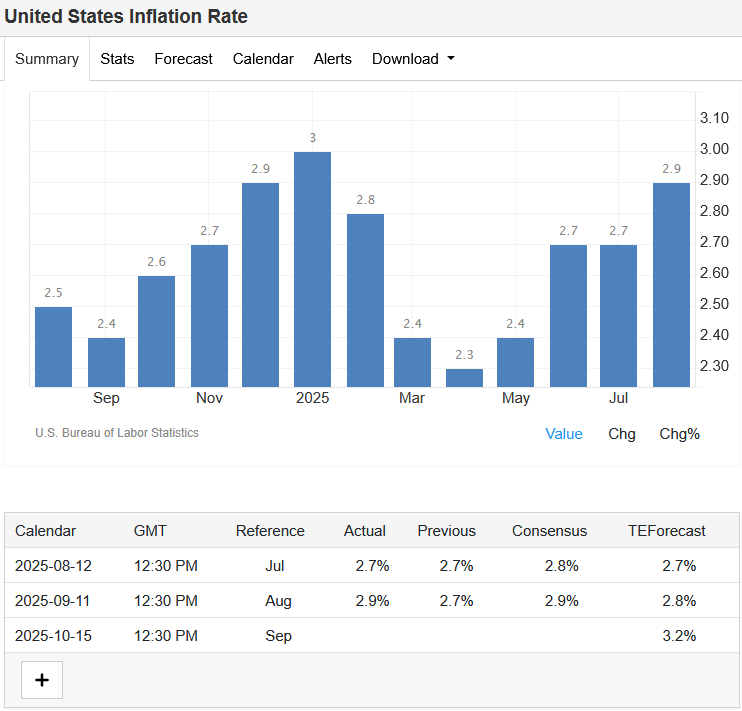

So, let’s start with the US economy, which we can see isn’t in great shape, according to the metrics published a few days ago. However, that’s a good thing for our investments, and I’ll explain why below. These metrics include the PPI, CPI, and CORE inflation in the US, as well as the unemployment rate.

As we know (or maybe don’t), the Federal Reserve, which is responsible for keeping inflation in check in America, looks at several metrics to determine what policy to implement—a policy of cutting the benchmark interest rate (rate cuts) or raising it (rate hikes).

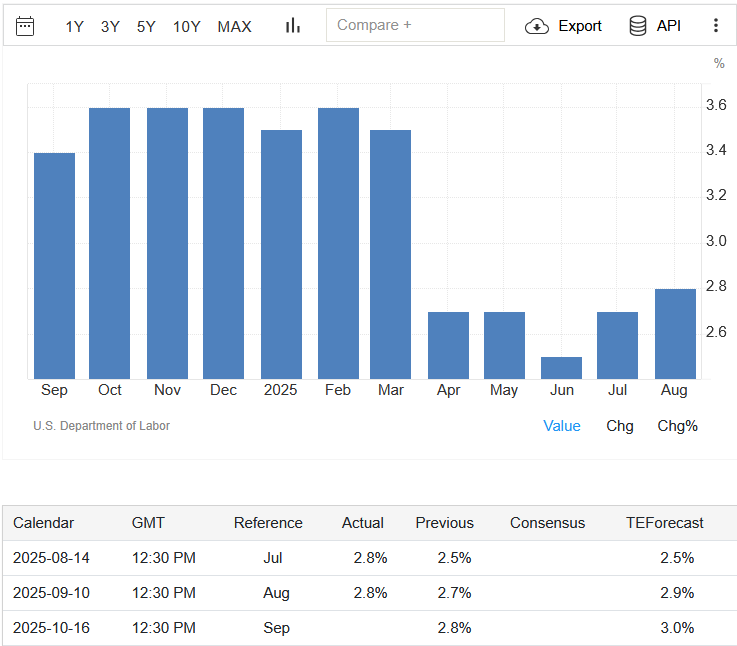

One of these key metrics is the PPI, CPI, and CORE inflation indexes in the US.

If you look at the images below, the PPI index was expected to increase by as much as 0.4% (largely due to Trump’s tariffs), but it actually came in lower than expected at 0.1% / 0.4% decrease from the forecast. To clarify, this number reflects the increase in the price of products or components in the US from the producer’s perspective.

This is a very positive factor that will contribute to the Federal Reserve cutting the benchmark interest rate.

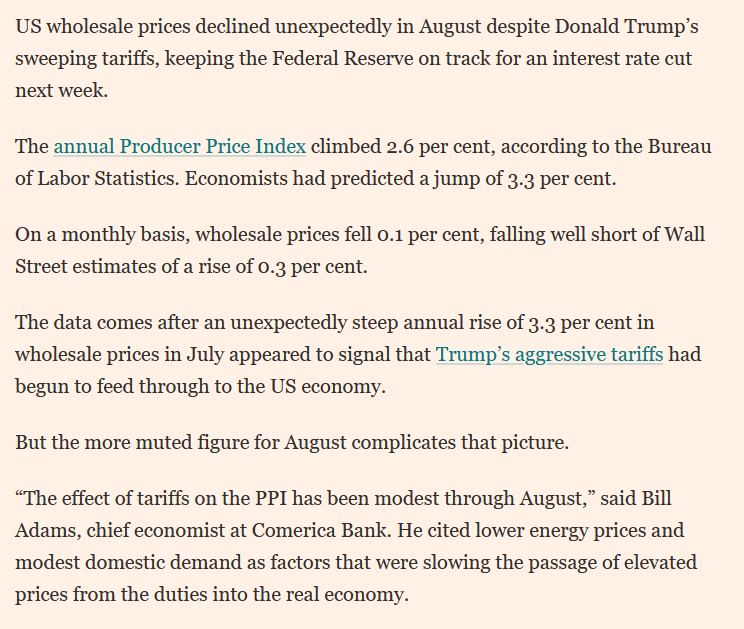

But let’s look at the other metrics, the inflation rates.

We can see that inflation is up 0.1% from what was expected and is currently at 2.9%, which isn’t terrible. However, it’s not a positive sign for cutting the benchmark interest rate, since the Fed aims to bring inflation down to around 2%.

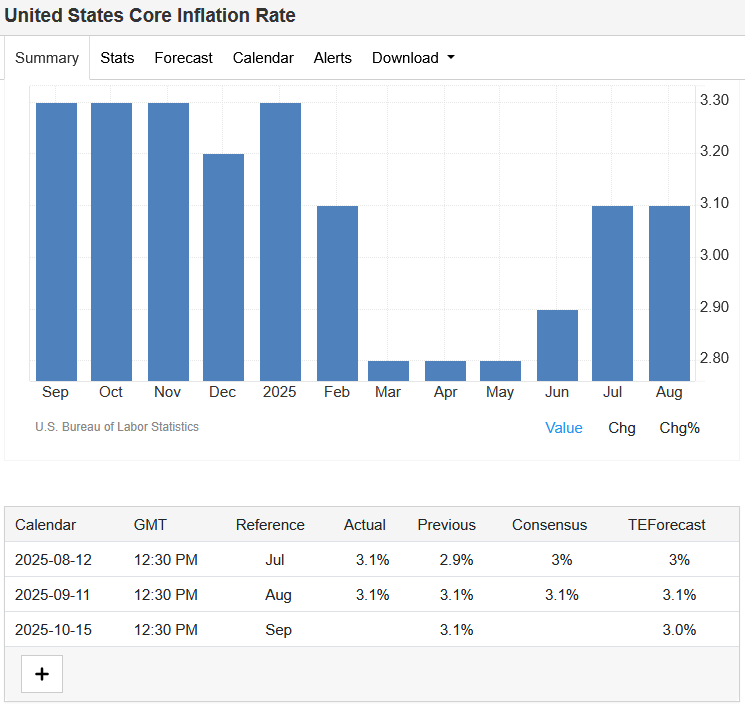

Likewise, if we look at the CORE inflation, it remains unchanged from the expected 3.1%. While this is a positive development compared to expectations, the percentage itself is not what the Fed wants to see.

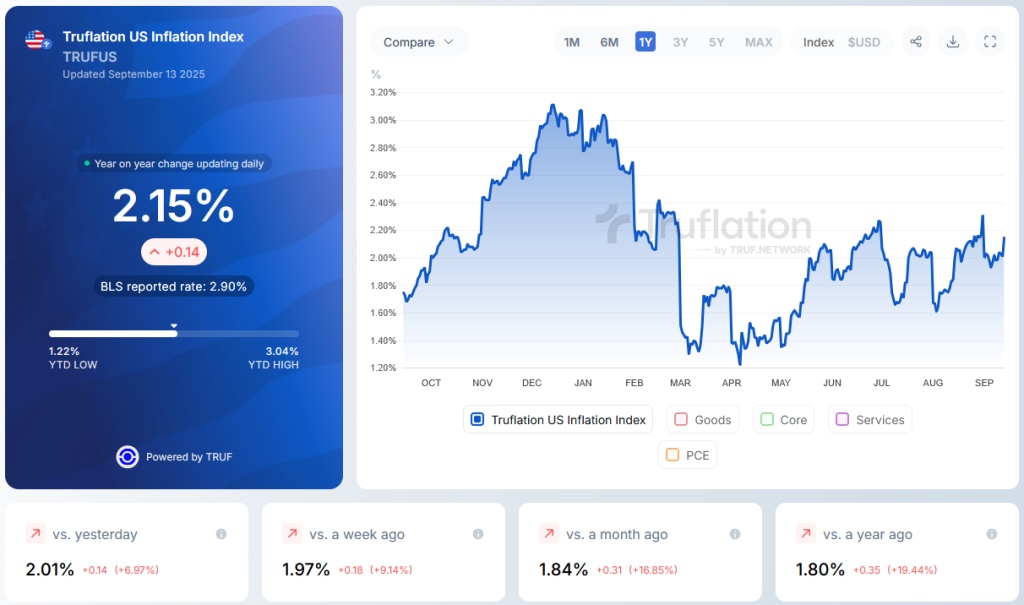

I always look at another inflation metric that I consider to be the most accurate: Trueflation. Compared to last month, it has increased by 0.31% and is now at 2.15%, which is realistically the number the Fed is fighting to achieve.

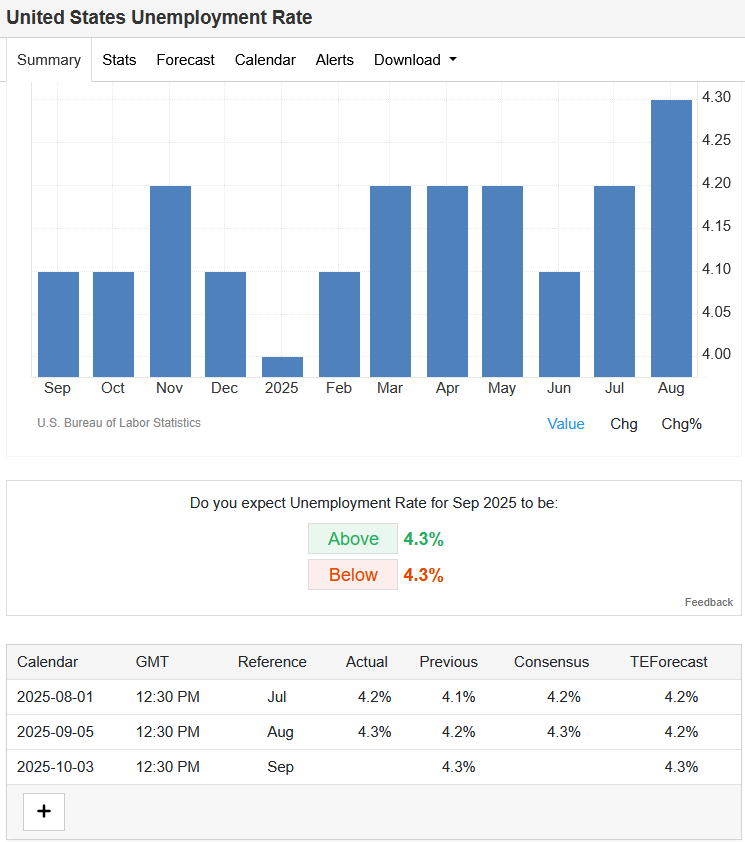

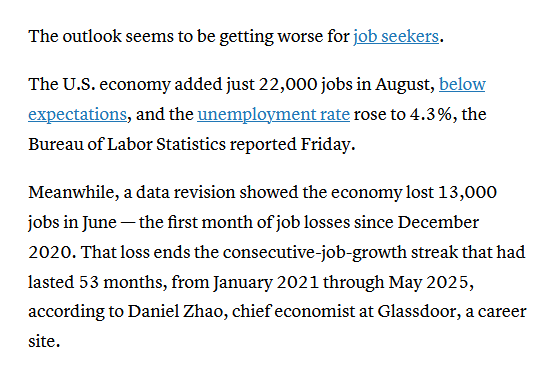

Besides these, other metrics are also monitored, such as the US unemployment rate, which is a crucial factor in the Fed’s decision to cut the benchmark interest rate. To be clear, the Federal Reserve needs to keep unemployment below 4%. However, as you can see in the image below, the unemployment rate is at 4.3% and has increased since last month, which is a positive factor for a rate cut. Honestly, I think the increase is small, as the market has lost jobs—or rather, fewer jobs were created than expected—specifically, 22,000 jobs below expectations. A revision for the June period also showed that 13,000 jobs were lost. These metrics show that the Federal Reserve’s policy is putting a strain on the US economy. This is because when benchmark interest rates are high, companies don’t expand their businesses, they save money and don’t hire new staff.

Based on the expectations, which were skewed by the tariffs, the numbers should have been quite different, which is why the Federal Reserve didn’t cut the interest rate at their last meeting.

Also, as president, Trump and the people around him are putting a lot of pressure on the Fed to make a bigger cut to the benchmark interest rate, and they have even threatened to replace the Fed chairman.

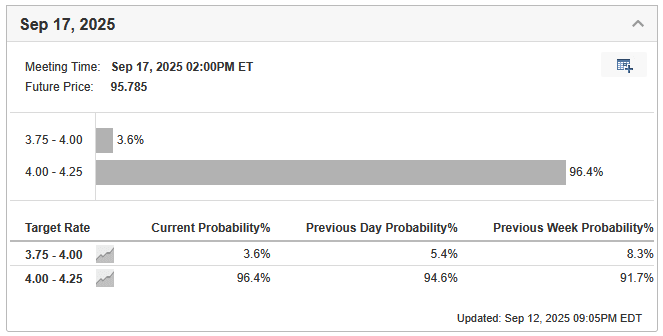

Their next meeting is on September 17th, and based on everything happening in the US, the question isn’t whether they’ll cut the interest rate, but by how much. As you can see in the images below, there’s a 96% certainty of a 0.25% cut, but there’s a 4% chance of a 0.50% cut. In my opinion, they should cut it more because the US has a debt it needs to manage, and the interest on that debt is too high with the current rate. They are also far behind Europe and other countries that started cutting their rates months ago.

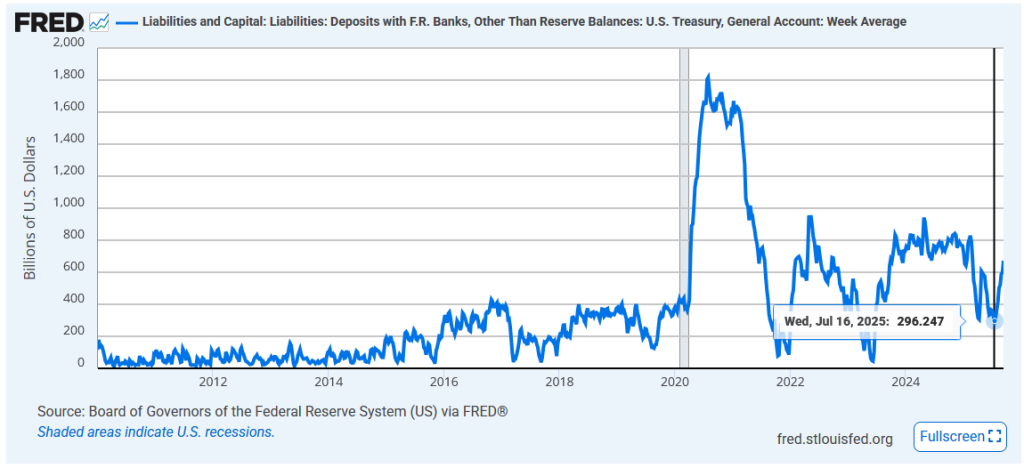

And I shouldn’t forget to mention that the government itself doesn’t have the money to fulfill its obligations, so it had to spend money from the Treasury’s reserve fund, and in just a few months, it spent as much as $300 billion. This budget needs to be replenished, so we’ve seen the fund return to its previous level of $600 billion over the past two months.

Now, what does this mean? It means that the money that is free to use—for borrowing, in other words—is returning to this fund, which creates a tightening effect on monetary policy. In the short term, this is bad for the market, which is why we’ve seen stagnation in the prices of crypto and the overall market over the last two months.

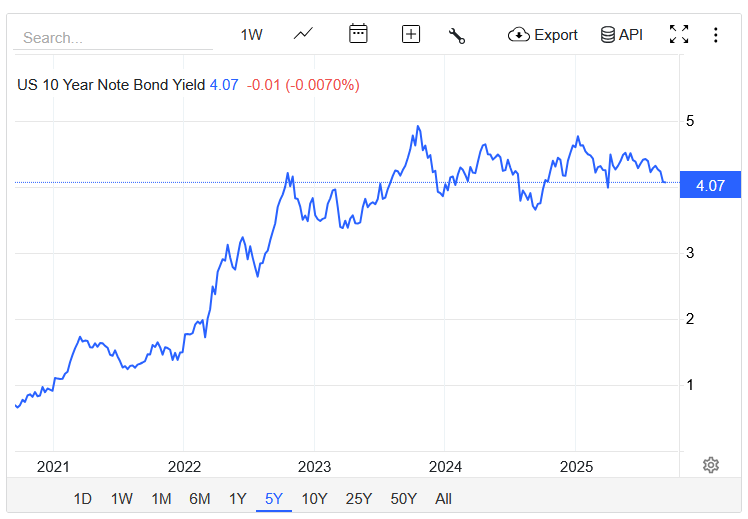

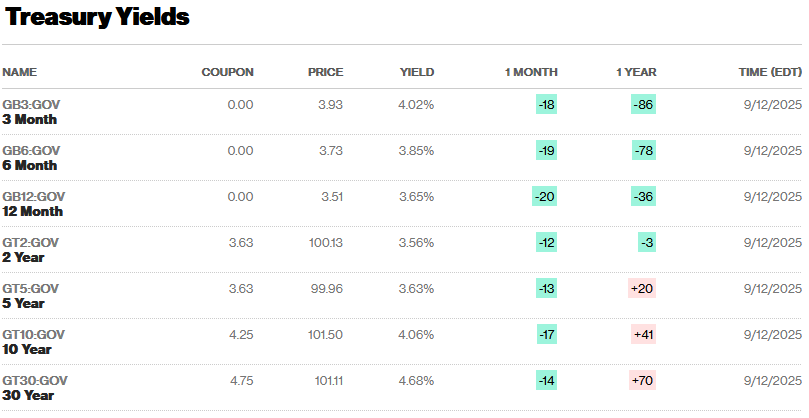

Here, I must also mention the issuance of bills, notes, and bonds, which are how the US government directly finances itself. However, we know that no one is interested in buying these bonds, which is why the returns, or interest, on buying them are so high. In the image below, you can see a slight decline in bond yields, but it is still too high when compared to previous years.

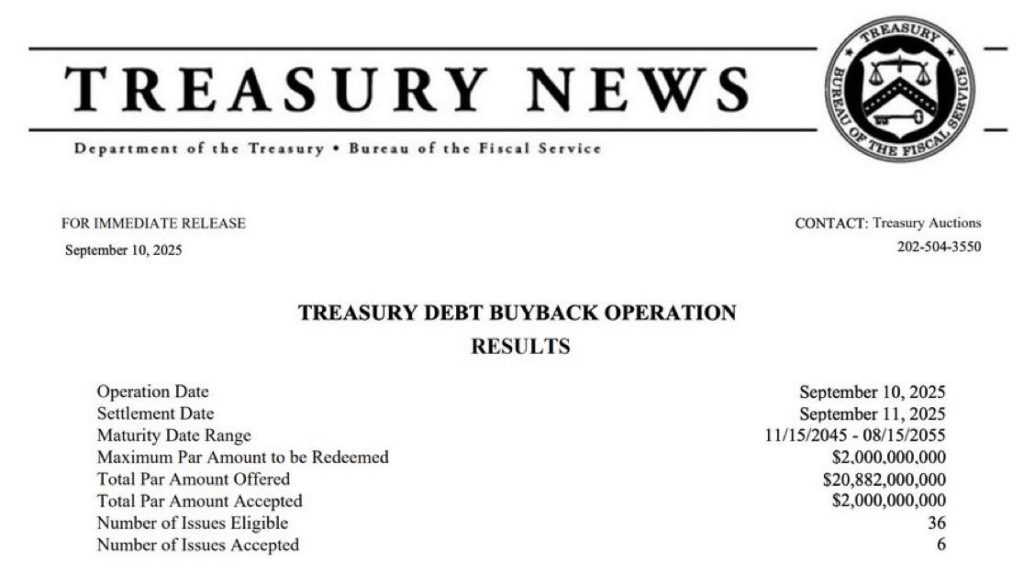

The decrease in bond yields was achieved by the US Treasury buying bonds back from their owners, which reduced the number of bonds on the market and, as a result, lowered the yield. I have no words for their “broken” economy, but this is how not only America but the entire world functions. In the image below, you can see that in the last four weeks, as much as $10 billion in bonds have been bought back.

I don’t know whether to say this, but this kind of economy is very bad, and there’s no escaping it. It would be very dangerous if the Federal Reserve didn’t loosen monetary policy—that is, if it didn’t inject dollar liquidity into the economy, America would experience a state bankruptcy, and this would be felt worldwide. I won’t go on, as I could write for another five hours and the post would be too long.

We can also see that the dollar index, or DXY index (which represents how strong the dollar is compared to other currencies), is starting to fall, and that is a positive sign for the crypto market, meaning crypto prices will likely rise!

In conclusion, I’d like to say that what’s happening is positive for our portfolios, and we can expect a significant increase in crypto prices in the near future. My assumption, and I would even say my claim, is that the peak for coins and tokens will be reached as the benchmark interest rate is lowered. To be clear, the Fed will continue to lower the rate even after the coins have reached their peak.

And again, I must explain that the most important thing is to have a plan for when to cash out, or take your profit, and not expect that you can catch the absolute top!