The economy and politics are so dynamic that things change every day. Honestly, so many things have changed in a month that I think I’ll miss explaining some of them in this post. But anyway, let’s start with the US economy, and I’ll give some of my projections for what I expect to happen in the future.

As we know, several important economic metrics for the US are released every month, and we’ll analyze those metrics now.

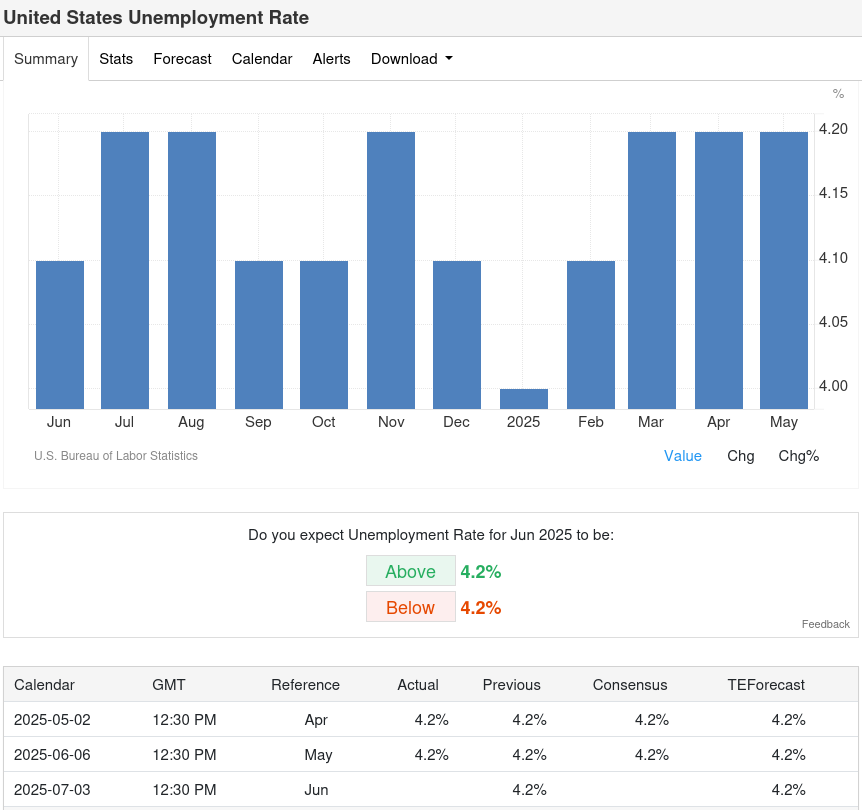

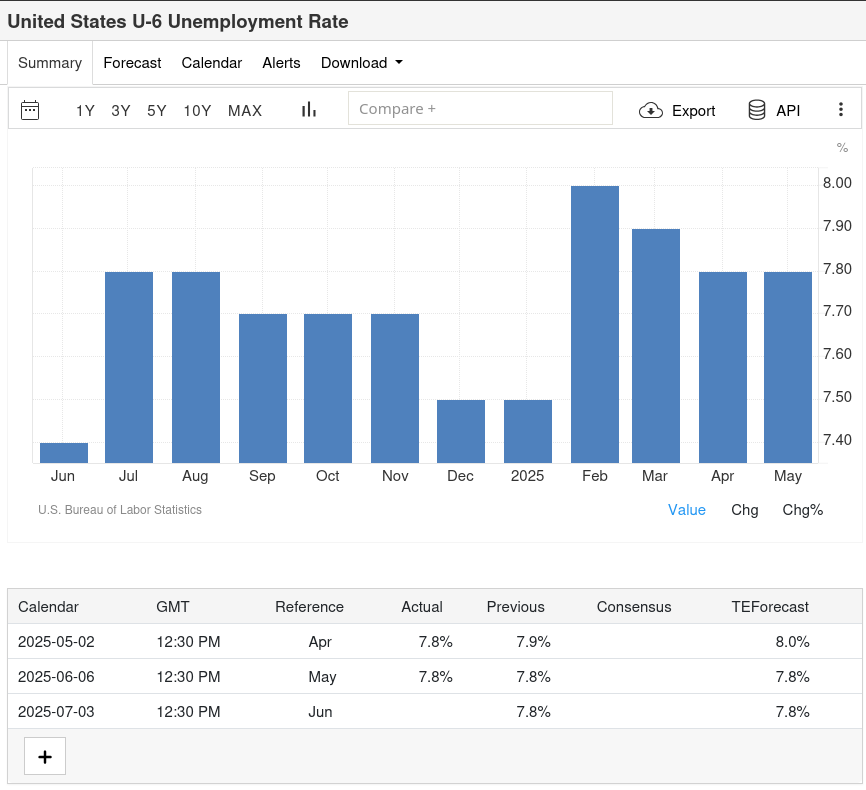

On June 6, 2025, the US unemployment rates were first released, and as we can see in the images, unemployment has remained the same, at 4.2% and 7.8%. These two indicators show unemployment in America: the first index shows full-time unemployment, while the U-6 index also includes those who have temporary work. The point of these indicators is that if they are above 4% and above 8%, respectively, it’s an indicator for the Federal Reserve that they should lower interest rates. However, the reduction doesn’t depend solely on these indicators. It also depends on other things, which I’ll explain below.

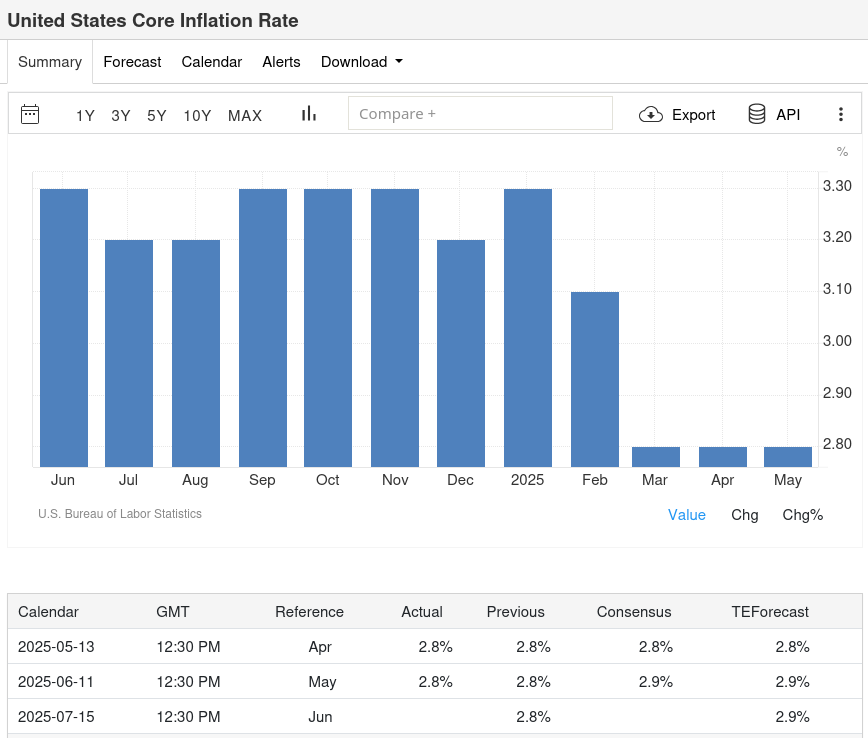

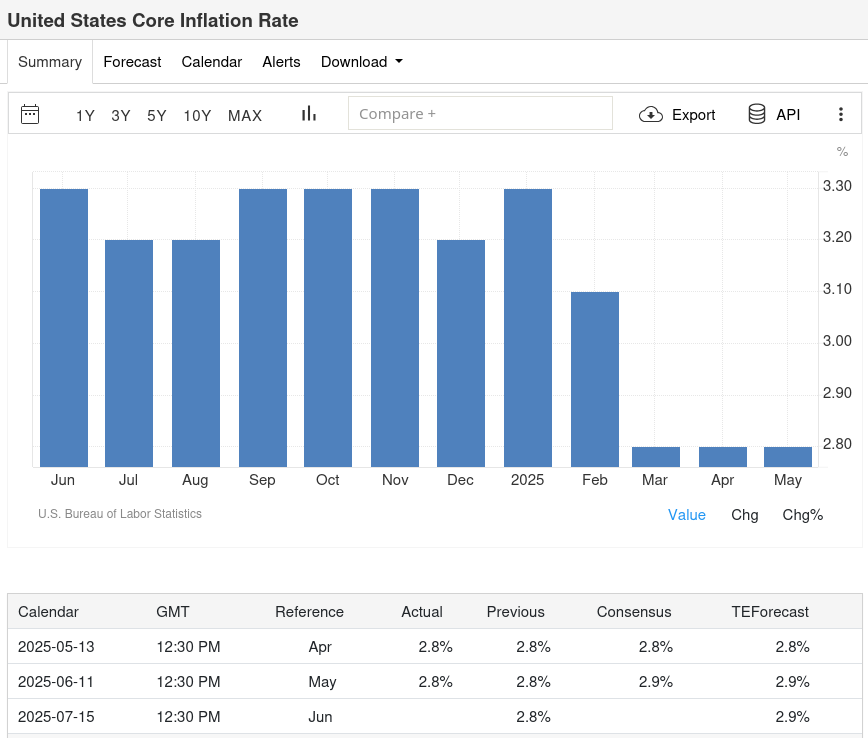

On June 11, inflation rates in America were also published. Now, these rates have increased by 0.1%, which isn’t very good for the overall economic situation. The only good thing about the inflation rates is that they turned out to be lower than the assumption: 2.8% instead of 2.9% for the Core inflation rate and 2.4% instead of 2.5% for the CPI inflation rate. What’s bad? Whenever the inflation rate increases, it’s an indicator that the Federal Reserve should not lower the benchmark interest rate, as this would cause much greater inflation. I’ll explain my theory on why this is the case below, with which not everyone has to agree.

In my opinion, the best indicator for inflation is “Trueflation,” which shows that it has increased by as much as 50% in one month, from 1.3% to 2%, which is really a lot, but there’s a reason for all of that. You can see the inflation rates in the images below.

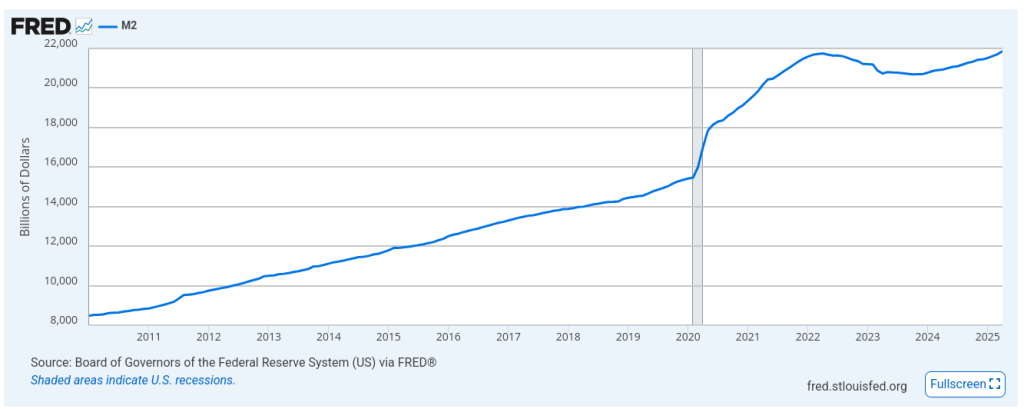

Now, let me return to the printing of money in the US. In the picture, you can see that the M2 index is slightly increasing, and when this indicator starts to grow sharply, it means that more money is being released into circulation (or “money is being printed,” as people say). With a delay of 3-4 weeks, the crypto market should also grow.

I also must address another very important factor, which is bond yields, which are very high. When bond yields are very high, there won’t be a reduction in benchmark interest rates. This means that no one is buying the loans that the US government wants to take out, and they have to offer a higher percentage of earnings for someone to buy them. You can see the bond yields and the M2 index below.

To be complete, I must say that we haven’t yet fully seen the effect of the tariffs; that is, due to the tariffs that were introduced, we also have a short-term increase in inflation. My assumption is that inflation will increase in the coming months, even though a trade agreement was reached between China and America. In the long term, inflation would decrease due to less spending by the public and fear of a recession.

Besides that, I don’t know how closely you follow it, but deportations of undocumented immigrants are happening in America, and not just of them, but even of people with business visas, green cards, and so on. I honestly don’t agree with this, but I think the ultimate goal is for people to give up work, specifically those who are undocumented, and thereby increase unemployment, which is an indicator that the FED should lower the benchmark interest rate.

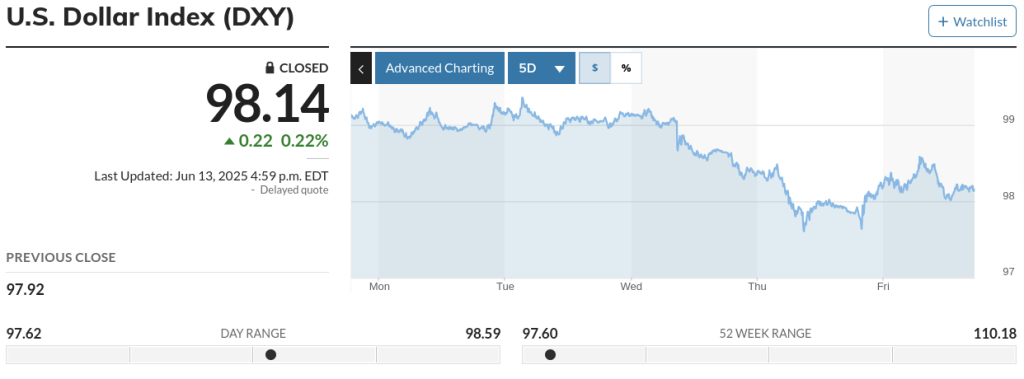

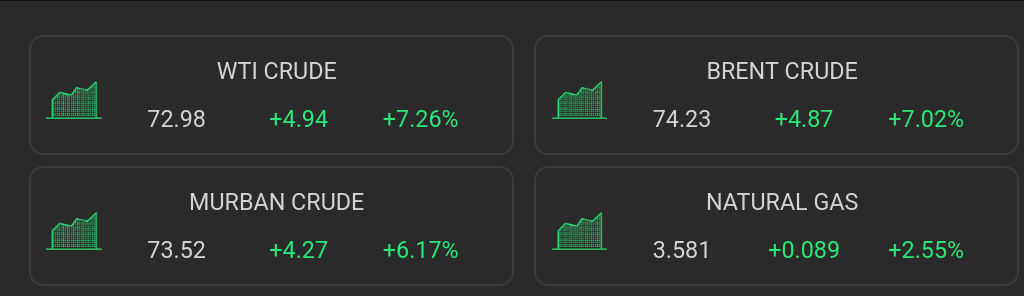

And the last thing I must mention is the war with Iran and Israel, which was a shock to the markets, and we saw a sharp drop in crypto prices and the market. This is certainly bad for the market, as a major war and crisis would have a large effect on risky assets, and cryptocurrencies are still considered part of them. In recent days, we’ve seen a fairly significant increase in oil prices and a smaller increase in the DXY index, which represents the strength of the dollar against other currencies. Now, my opinion is that this war won’t stop anytime soon, and if it deepens with many casualties and the destruction of important infrastructure, it would have a greater negative effect on the markets. There’s even a supposition that if this happens, there could be a closure of a strait known as the Strait of Hormuz, which is very important for the transport of oil across the ocean. As much as 20% of global trade passes through here. If this happens, and I don’t rule out the possibility, we could see a large correction in the markets and a huge jump in oil prices! And with this, if we think a bit, out of fear of war, people won’t spend money, they won’t buy goods, and they would protect their capital in bonds. And if that starts to happen, we’ll see a decrease in bond yields and thus a decrease in the benchmark interest rate by the FED.

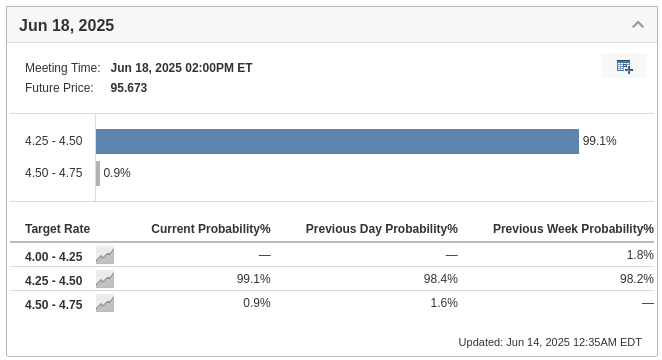

As you can see in the image below, there will be a Federal Reserve meeting on June 18th, and with 99% certainty, we won’t see a cut in the reference interest rates. In my opinion, when the rate cuts do begin, they will happen at a more aggressive pace in order to stimulate the U.S. economy as quickly as possible. It remains to be seen when that will actually start.

Now, how long will we as investors wait for a bull market?

No one knows this because major political games are being played, and we as investors, especially from Macedonia, cannot influence the geopolitical scene in any way; our only option is to wait! If there were a nuclear war, which there won’t be, the entire world would simply collapse, and there would be no future on Earth, so I rule out this option! By aligning the above pieces, i.e., leading the US into a recession and causing fear among the people due to the geopolitical situation and shifting capital into a safe investment like US bonds, we would have the desired effect of an increase in risky assets. We also need to know that our 5 minutes will come, and we’ll need to make a decision when to take profit and be satisfied with that profit, because great mistakes are made with greed.

This is just my opinion on how things are moving, and not everyone has to agree with me.