Where do I even begin when I think about everything happening in the world—economy, crypto markets, tariffs, and so on?

Let’s start with the inflation metrics in the U.S., because they’re the most important—after all, our entire investment in crypto depends on them… or does it?

To be honest, after so many years of following the situation and everything that’s been going on, I’m starting to see that it’s all one big game. I’ll explain why below.

Now, let’s look at the metrics:

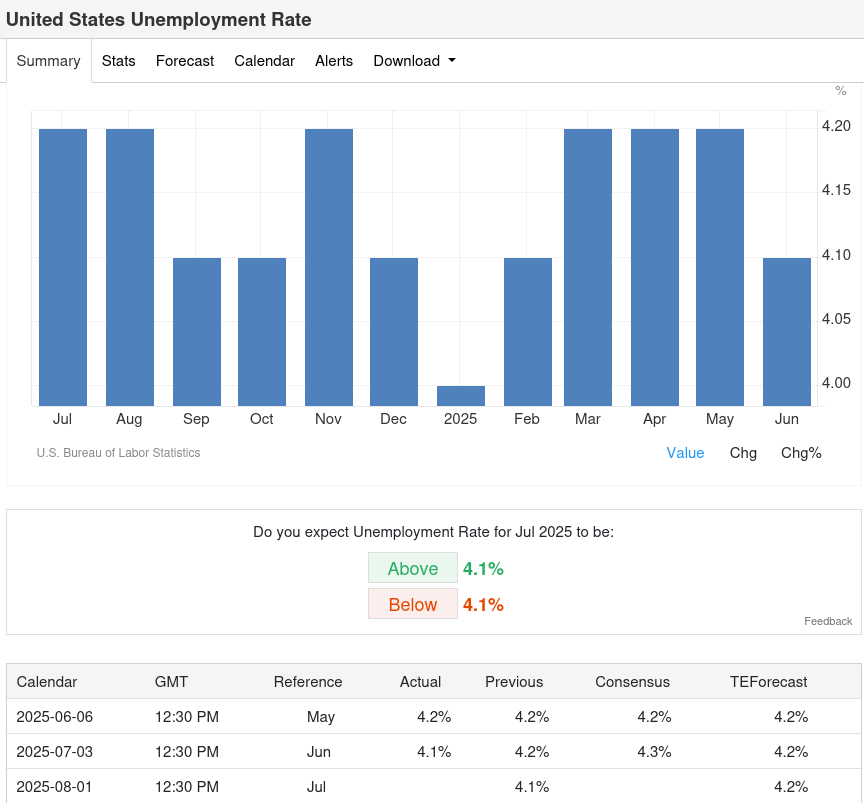

First, let’s check the U.S. unemployment rate. As we can see, the unemployment rate for June is lower compared to the previous month, but it’s still above 4%, which is one of the indicators that the Federal Reserve should consider lowering the reference interest rate.

But let’s continue and see what’s going on with the U.S. economy:

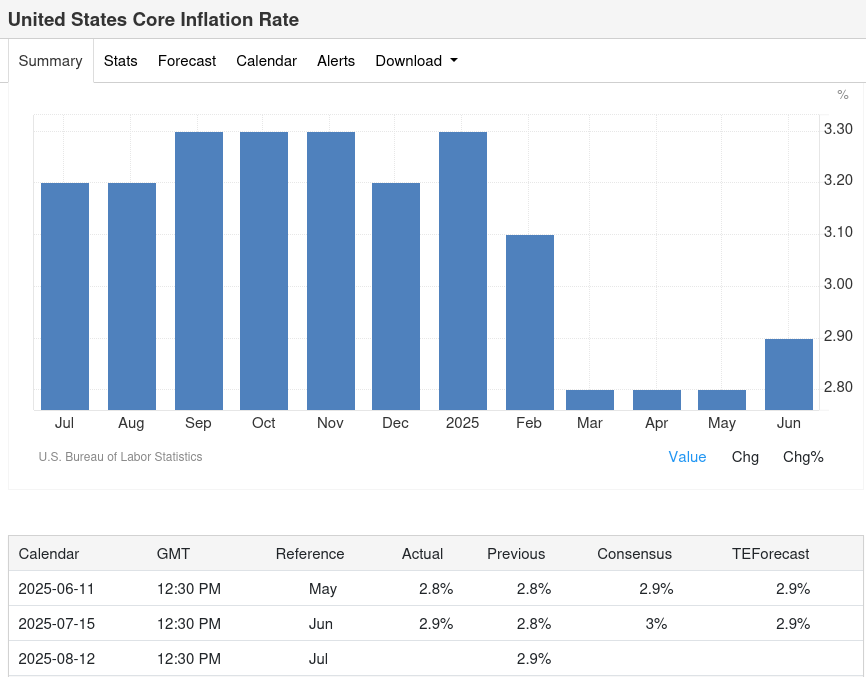

Core inflation in the U.S. has increased compared to the previous month (May), and the current core inflation rate is 2.9%, which aligns with the expectations from May.

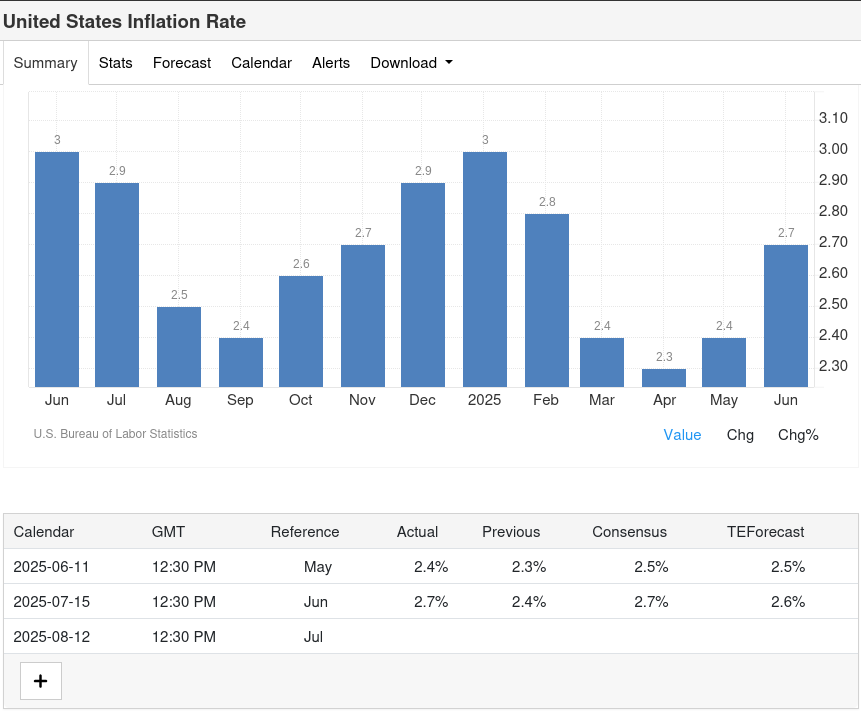

If we also look at the CPI inflation rate, we can notice it’s on an upward trend—it increased from 2.4% to 2.7%, which was realistically expected given the actions taken by the U.S. government, i.e., Trump.

We know he changes his mind overnight and imposes tariffs on whatever he wants. My honest opinion is that he’s doing all of this to force the Federal Reserve Chairman to cut the reference interest rate.

Now, as we can see, these tariffs are increasing inflation in the U.S., but that’s short-term. If they continue with heavy tariffs and customs duties over a longer period, it would actually lead to a decrease in inflation. To explain briefly—people would spend less due to higher prices, which would result in a recession and lower inflation.

I must also mention the Truflation index, which has also increased and is already over 2%, which realistically means that inflation is rising in the U.S.. I mention this index because, in my opinion, it’s the most realistic representation of actual U.S. inflation.

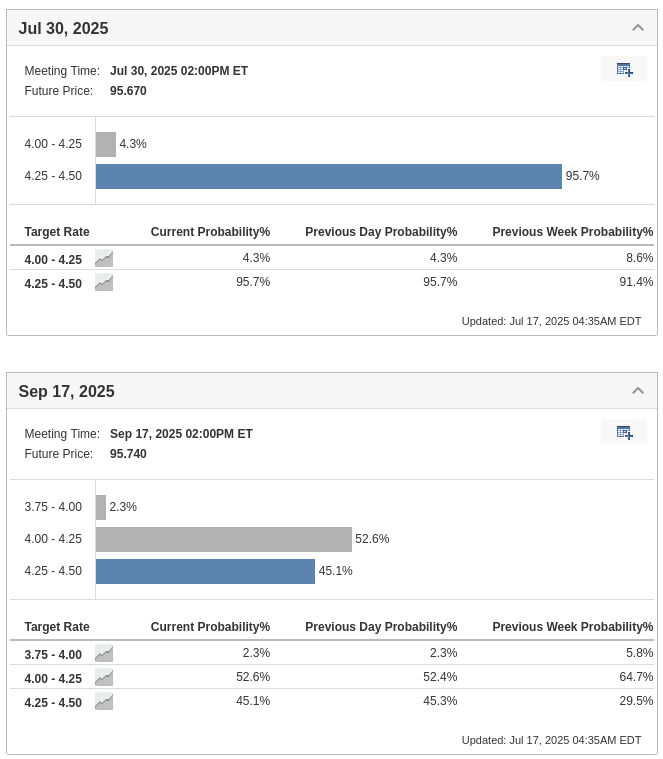

Now, I’d like to talk about the potential rate cut by the Federal Reserve—will it happen now in July or later?

According to the metrics, i.e., the Fed Rate Monitor Tool, we can see that the chance of a 0.25% interest rate cut is just 4.3%, which means we likely won’t get a cut in July. Also, if we listen to what the Fed Chair is saying, we’ll see that even he wants to wait and see what happens with Trump’s tariffs. If they cause inflation, he’ll keep the rate as is.

It’s too early to talk about September, but according to some metrics, the likelihood of a rate cut is significantly higher.

As we can see, the entire U.S. government is putting pressure to cut the interest rate, and I wouldn’t be surprised if President Jerome Powell gets replaced by Trump. Honestly, given what’s happening, that would be the least surprising outcome.

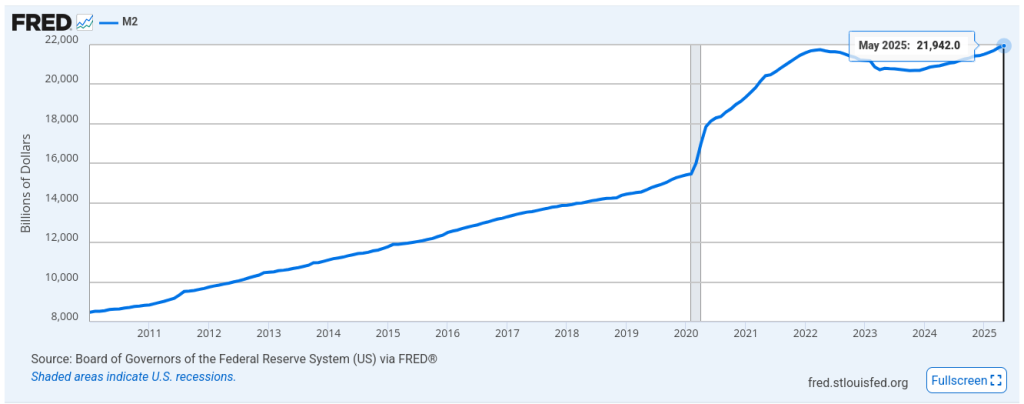

Now let me touch on the M2 index, which simply represents the total amount of money circulating in the system. This index has been increasing in recent months, and naturally, we expected a rise in assets like crypto, traditional markets, etc. We also saw crypto jump 20–30% in the last week, with Bitcoin hitting a new ATH.

I must mention the bond yield in the U.S., which is extremely important and is one of the key indicators the Fed watches when considering rate cuts. From the chart below, we can see that bond yields are very high, meaning that very few bonds are being purchased. As I’ve said before, this is important because bonds are the main instrument used to fund the U.S., and if they don’t get the money they need, it would mean bankruptcy of the whole country. I’m 100% sure that won’t be allowed to happen.

The correlation between bond yields and interest rates is that high bond yields = high interest rates. Someone might ask why, but explaining that would take another 3 hours, and the post is already long enough. For now, just take it as is. I’ll just say that these bond yields need to drop in order to stimulate the economy, i.e., print more money.

And once again, I have to mention Trump, who is seriously going off the rails with what he’s doing—but the man has a goal: to cut the reference interest rate. I don’t know if you’ve been following, but the guy just threatened 100% tariffs on Russia, imposed 30% tariffs on all of Europe, and is now talking about new tariffs on chips and medicine starting August 1st.

Honestly, I’m speechless—but he’s the boss in America and will do whatever he wants. In the future, I expect these tariffs to stabilize, but we’ll see when that happens. My guess is: once he gets what he wants—a lower interest rate and $5 trillion in funding passed through the so-called Genious Act.

Lastly, there are now positive crypto regulations happening in the U.S., and what I used to say was bad for the people is now banned: the Anti-CBDC Act. That’s great for me, because it delays the total control over the people via CBDCs. Not that crypto won’t be used for control, but CBDCs are much worse.

As for control through crypto—I’ll explain that in more detail when I get the time. In short: crypto is not the ultimate solution to avoid control. I do believe it’s good to make a profit, but it’s not the escape route from being controlled.

And now I want to say that, as we’ve seen, the market doesn’t actually depend on any of these metrics. Based on these numbers, there should’ve been a drop—but what happened last week? Crypto saw an insane surge!

Sure, economic stimulus in the U.S. will help crypto grow—but we shouldn’t only rely on that to decide when to buy or sell! My honest opinion is that the top of the crypto market will happen during the period of interest rate cuts, not after the bottom is reached, when massive money printing begins in the U.S.

This is just my opinion—it doesn’t have to be true, because I’m not in Trump’s or Larry Fink’s head. But based on all I’ve seen, this is my analysis.

That’s why everyone should have their own plan, figure out when to take profit, and do the math on what suits them. No one can predict the top—except maybe BlackRock’s quantum computer! 😄