What can I say about the latest economic metrics in ‘Murica and the geopolitical situation?

As you can see, the wars between Russia and Ukraine, and Israel and Palestine, are slowly calming down (not that they’re fully calm, but there aren’t such massive tectonic shifts like before Trump came back as president). Also, in the past two weeks, we saw the start of another war, which was quickly put on pause. As usual, the U.S. showed up as a mediator in all these conflicts and supposedly managed to cool things down.

In recent days, agreements on tariffs were also announced, leading to a pause on the tariffs between China and the U.S. (they’ve been reduced for a 90-day period).

How does this affect crypto and the market?

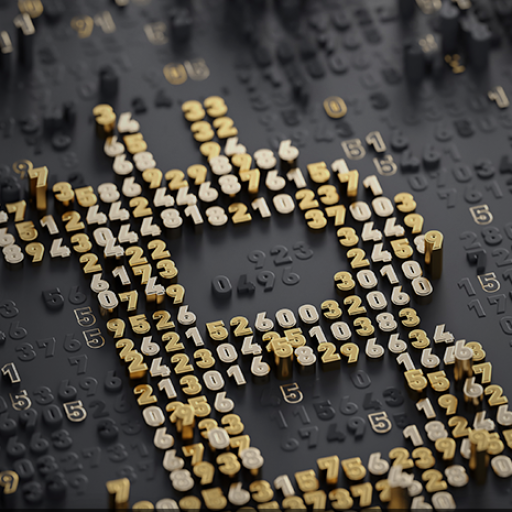

Big events like these are used to manipulate the markets — especially crypto — in order to liquidate gamblers who go long or short. In image 1, we can see that gamblers were destroyed this past week, which is why crypto shot up — a classic short squeeze.

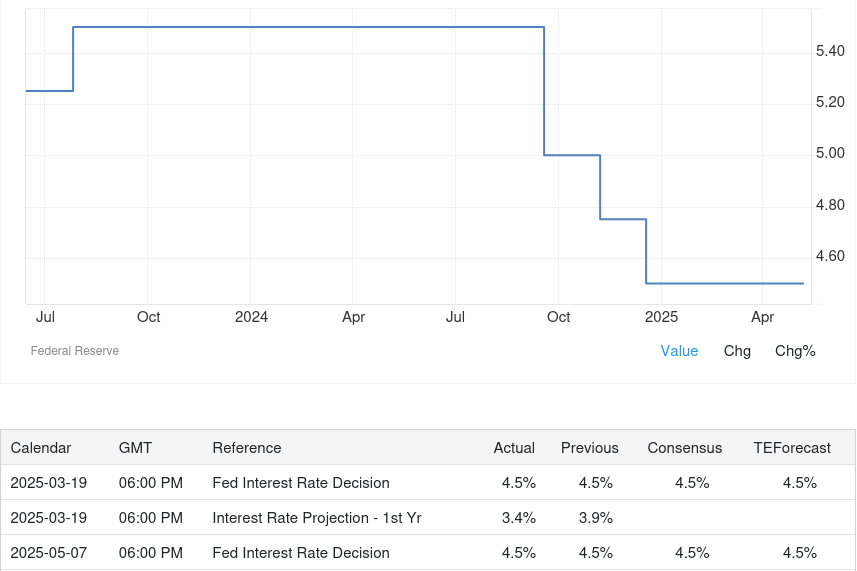

Even when the Federal Reserve announced they wouldn’t lower the federal interest rate, crypto kept climbing. And that’s because too many gamblers were shorting Bitcoin. There’s one saying I remember:

“Never short Bitcoin!”

A great quote, and I think it’s something we should stick to when investing in crypto.

Also, as you can see, Trump is so focused on making money that even he doesn’t know what he’s doing anymore. He’s buying Bitcoin, Ethereum, launching a stablecoin, making deals — all to make money. That in itself should be an indicator that crypto will rise! There’s no other way — it has to go up, so Trump can make money too.

Back to the U.S. economy and what happened recently — inflation and money supply.

I know many of you are worried about this, but to be honest, I don’t see anything alarming. The Federal Reserve will have to lower the interest rates eventually.

Why?

Because inflation in the U.S. is low — maybe not as low as they want, but still low.

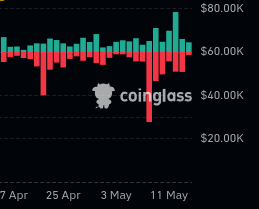

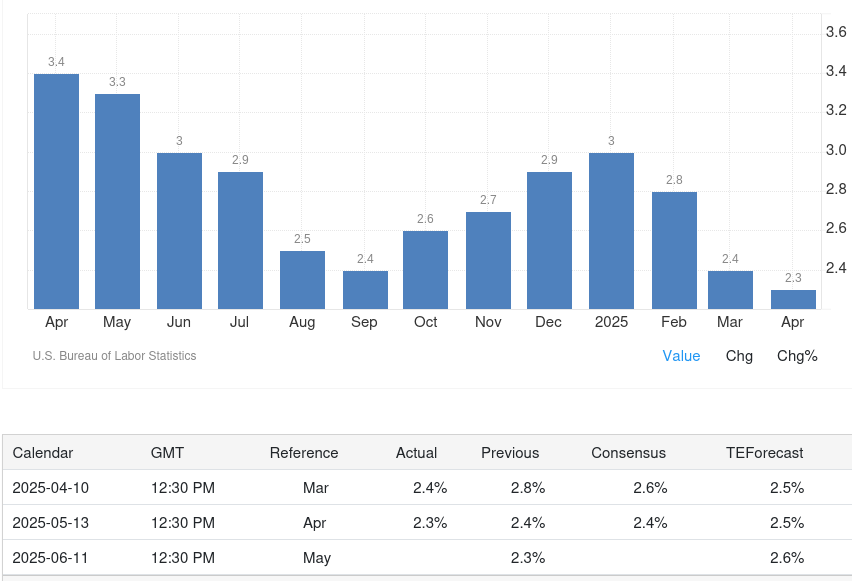

If we look at the chart (image 2), we’ll see expectations were for CPI to be 2.5%, but it turned out inflation was 2.3% — a full point below the previous reading. Core inflation stayed the same, which isn’t bad (image 3).

Also, if we look further down, Truflation also decreased, which is another indicator that the Fed must lower interest rates.

Now, when exactly they’ll do it — we’ll see, but it’s inevitable.

The Fed sees unemployment below 4% as healthy. But as shown in the chart, unemployment is now at 4.2% — another signal that rate cuts are coming.

A few days ago, the Fed stated that they don’t plan to lower rates yet because they’re still not sure inflation has reached their target.To be honest, I don’t even expect core or CPI inflation to fall below 2% — that’s why I follow Truflation as my go-to inflation metric.

Now here’s where things get tricky:

The bond yields are high — around 4.5%.

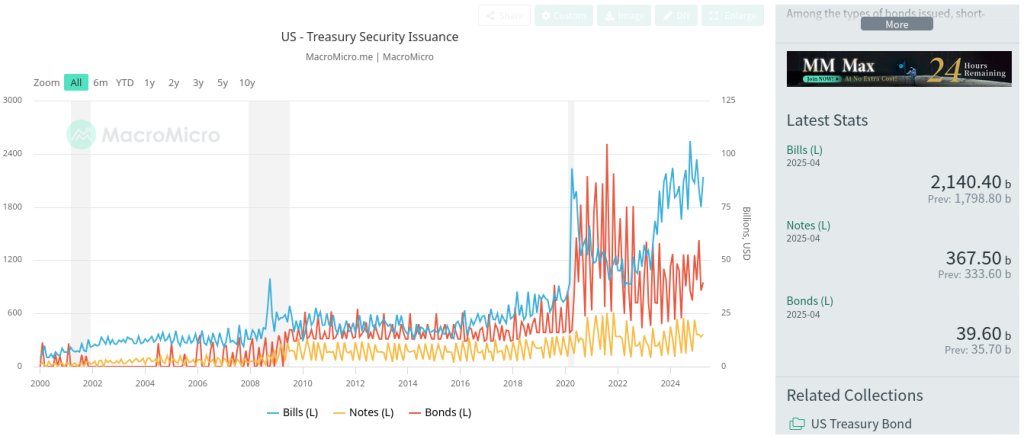

This is directly tied to Fed policy. As you may or may not know, the U.S. Treasury issues bills, notes, and bonds to finance the government.

But because so many of these instruments are being issued, and demand is not high enough, the U.S. government has to offer higher interest (yields) to attract buyers.

In the chart below, you can also see that the Chinese government is selling (not buying) long-term U.S. bonds. That means more supply, less demand → yields stay high.

In simple terms: There’s no strong recession fear, so people aren’t rushing to buy bonds — which means the yields must stay high to attract buyers.

That’s why the Fed hasn’t lowered interest rates yet.

What needs to happen for bond yields to drop?

The Fed needs to be certain inflation is coming down (and it seems like it is so far), or something big needs to happen in the U.S. economy — like: A recession, Bank failures, Corporate bankruptcies

From my point of view, one of these will happen, which would lead to Big interest rate cuts and Fed absorbing U.S. debt.

That’s why I think Trump made the tariff move — to push the U.S. into a recession and force the Fed to lower rates.

My guess is that pausing the tariffs is a signal that rate cuts are coming in the next few months. If the Fed doesn’t cut, the tariffs will resume. This is just my opinion — we’ll see what happens.

So what now?

We need to wait and see when the Fed starts quantitative easing, because that’s when both crypto and traditional markets will rise significantly.

Most important of all you need to have a plan for when you’ll cash out — decide your target price to sell your crypto and take profit.

Of course, not everyone has to sell, but I personally plan to.

So, in the near future, I’m expecting new all-time highs in crypto!